How to Retrieve Your CBS Report

Have you ever been turned down for a car loan or personal finance on account of your credit history? As a borrower, having good credit can often mean the difference between a loan application approval or rejection – especially if you’re applying via banks or similar banking financial institutions.

These days, many money lenders in Singapore will look more favourably upon debt and a low credit score than banks. That said, having a good credit repayment history can still greatly increase the probability you’ll get your loan application approved.

Here at Moneylender Review, our news, reviews and loan comparison website help borrowers just like you access the information they need to make better financial decisions. Let’s take a look at what you need to do if you want to retrieve your credit report.

What is a Credit Bureau Report?

A Credit Bureau Report, also commonly known as a credit report or CBS report, is a unique profile that documents one individual person’s credit background, payment history and debt situation.

Put simply, it shows how regularly you, your friend or the person profiled is late when making repayments. It also contains evidence of how much money you have borrowed over the years, whether that be via a credit card, loans or other credit facilities.

When you apply for a car loan, personal loan, renovation loan, credit card or other type of finance, banks and money lenders will consider your credit reputation. Having good credit will increase your probability of getting that credit card or loan application approved.

In contrast, low credit scores and a poor payment history could result in a rejection, unless you’re comparing loans offered by more lenient money lenders. Interestingly, these competitive deals don’t necessarily offer higher interest rates.

What Does a Credit Report Look Like?

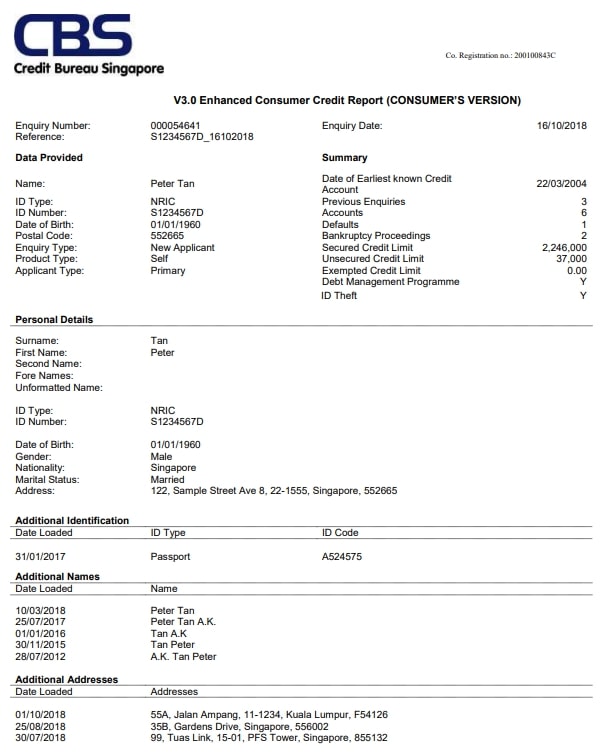

Never seen a credit report before? We’ve included a sample Credit Bureau Report below in the standard Singapore Credit Bureau style. Here, you can see exactly what typical credit reports look like and what information each part of the credit report contains.

Credit Report Sample:

Source: Credit Bureau Singapore

Click here for a complete sample report. As you can see, most credit reports will include:

- The full credit history of the named borrower

- Your personal profile and biodata (excluding contact information)

- Bankruptcy history (from 5 years after your date of discharge)

- Credit card debt history from the past year

- Records of closed or terminated credit accounts, including where you’ve hit a credit limit

- Payment default records (which will appear for 7 years)

- Credit limit and existing debt balance aggregates

How Can I Understand My Credit Score?

While a Credit Bureau Report (or credit report) offers banks and financial institutions a detailed collection of your previous credit applications and payment history, a credit score is a simple, numeric credit rating applied to your credit situation.

Basically, a credit score is a four digit number or “code” that credit bureaus, banks and money lenders will use to grade how well you keep up with debt repayments. This number will range from 1000 to 2000 – with those closer to the 2000 mark deemed most likely to pay their debts on time by credit bureaus.

Scores also sit on a “Risk Grade” scale denoted by two letters, which ranges from AA to HH. The best possible score (AA) covers borrowers rated between 1911 and 2000, while the lowest possible score (HH) applies to people with a numeric score range of 1000 – 1723.

Despite all this, it’s important to remember that whether you’re applying to member banks like DBS or HSBC, or comparing licensed money lenders offering competitive interest rates, your credit score isn’t the only thing that banks and lenders will consider.

With most loans, your annual income, employment history, any outstanding debts and other items like bankruptcy information, will all be closely scrutinized too.

What Factors Affect My Credit Score?

Having a basic understanding of what credit scores and credit reports are is one thing, but it’s important to understand how your credit rating is actually calculated, too. You can find detailed information about this on the Credit Bureau Singapore’s website, but we’ve broken down the basics for you below:

1. Payment history

This is one of the key areas credit bureaus will review. Anyone in Singapore with a solid record of making repayments on time has an increased probability of receiving a more favourable score. Those with big credit card debts and bad payment histories, however, might not be so lucky.

2. Credit utilization

This refers to the total amount of money a person has borrowed or “used” on their loans and credit cards. The amount used, or “utilization pattern” will affect your overall score.

3. Credit history length

Those with a longer-established credit history will usually be deemed more reliable borrowers by banks, money lenders and credit bureaus. This is because there is ample evidence of such borrowers making repayments. It’s also the reason consumers can often rebuild a bad credit score by applying for more finance and building up a better payment record.

4. Credit mix

This refers to the types of debt and/or accounts on a borrower’s record. Car loans, credit cards, mortgages and loans all make up part of the mix – and a greater mix shows a better ability to manage multiple debts (from a bureau’s perspective).

5. New or available credit

Any new credit or available credit a person currently has active can influence their overall score, either positively or negatively depending on utilization and payments. For example, lenders may perceive you to be over-extending yourself if you’ve recently taken out several credit cards.

6. Enquiry activity

It’s no secret that each time a new bank or money lender accesses your credit report in response to a new loan application, this will affect your score. This action is known as an “application enquiry” and having too many enquiries in too short a space of time could raise alarm with credit bureaus.

What Are the Benefits of Having a CBS Report?

The average credit report can contain more than 100 pages’ worth of financial information about you – which is an awful lot of data indeed! This covers not just credit information and debt records, but any history of court rulings and repossessions, too.

It’s important that you are fully aware of what’s held on record, and that you keep it in good shape, so it can be used to your advantage.

It is advised that people in Singapore should check their credit report at least once a year, and there are a number of reasons for this. It enables you to:

- Ensure the records held are 100% correct

- Determine your credit score and whether improvement may be required

- See that you are being accurately represented when applying for finance

- Rule out any concerns about identity theft

There are other benefits too – especially if you own a business.

Benefits for business owners

If you have an entrepreneurial spirit and are planning on trying to build a business, making sure you have a water-tight credit report is particularly important. This is because having a good credit report can help you to:

- Enjoy faster loan approvals

If your CBS report and credit facilities are clearly in good shape, there’s a greater probability you’ll be approved for a loan in Singapore if ever you feel like you could use a financial boost.

- Lease office space

Leasing new business premises in Singapore with a bad credit score can be a hassle, but if your business has a credit report in tip-top condition, you shouldn’t encounter any problems.

- Attract investors

Business investors in Singapore may want to review your report to see it meets their requirements before investing. What’s more, a business with a solid report is more likely to attract investors in the first place.

- Get lower interest rates on loans

A good credit score and favourable credit reports will always help you to secure lower interest rates on loans and other types of finance with retail banks, credit providers and money lenders.

- Enjoy higher credit limits in the future

Banks and other financial institutions in Singapore typically provider better loan limits, free credit and more favourable credit card terms to businesses that have proof of good credit reports and making their payments on time.

How Do I Get My Credit Report?

Credit reports will usually be managed by either the Credit Bureau Singapore or other credit bureau businesses, which could include credit reporting agencies. In most cases, you can request your report either online here or by visiting one of Singapore’s many 62 SingPost branches in person. Other methods of requesting your report include:

- Via the CASE or CrimsonLogic Service Bureau

- Using the CBS My Credit Monitor website service

Is It Free to Request My Credit Report?

Sometimes, yes. If you have applied for any bank or financial institution’s credit monitoring service, for example, you can usually get a credit report free within 30 days of receiving a standardized letter notifying you of using such services.

Credit reports will usually be managed by either the Credit Bureau Singapore or other credit bureau businesses, which could include credit reporting agencies. In most cases, you can request your report either online here or by visiting one of Singapore’s many 62 SingPost branches in person. Other methods of requesting your report include:

You might even be able to access your free credit report within a longer time period if you request it by mail, or in person by visiting CBS directly on site at their Shenton Way office.

Under some circumstances, you can also request a free credit file or report of your finances via the My Credit Monitor service. This will issue you with a free version of your credit report notifying you of any significant changes that may have recently been made. If you are required to pay, take note that each credit report is usually worth approximately $6 including GST charges.

What if There Is a Mistake With My Credit Reports?

If you ever experience or spot an error in your credit report, you will need to write to the credit bureau requesting a change – with evidence attached to support your claim. The bureau will then make any necessary enquiries and advise you on whether or not the information can be amended.